With the aftermath of Super Tuesday nearly cementing Joe Biden and Donald Trump as presidential candidates for the 2024 election, the stage is set for an unprecedented surge in political campaign spending. Unlike the 2020 election cycle, which was significantly impacted by the COVID-19 pandemic, this year's campaigns are expected to shatter spending records, posing both challenges and opportunities for advertisers. Let’s explore the key considerations amidst this surge and actionable strategies for advertisers to navigate the evolving environment.

Understanding the Current Landscape

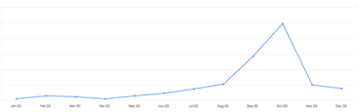

While political campaigning has already begun, albeit at a slightly lower level than last election due to a smaller primary, we typically see much lower levels of investment from January through July. Political spending is at its highest from August through October, with spend peaking during October and starting to pull back drastically in the first week of November.

Vivvix: Political advertising spend Jan ‘20 - Dec ‘20

Inventory Crunch in News and Business Channels

Political spend is heavily focused within news and business programs, with the major broadcast networks (ABC, NBC, FOX, CBS) being the primary focus for political spending. With politics dominating the inventory and the Olympics further exacerbating inventory constraints for NBC, advertisers will be faced with less availability and pricing premiums, with some channels being more impacted than others.

Balancing Traditional and Digital Channels

While TV remains a primary focus, digital ad spend is expected to increase, particularly in Connected TV (CTV) and social media platforms.

eMarketer is projecting an 86% increase in social political spend compared to the 2020 election. Like in 2020, Meta (Facebook & Instagram) is expected to lead spending and will continue with their dark policy for the week leading up to the election, preventing new political and issues campaigns from launching.

TikTok has been fraught with debate amongst government officials due to its connection to China, which was furthered recently by action in Congress to demand ByteDance divest TikTok from their parent company. Despite this, TikTok remains a vital channel to reach younger audiences. Its organic reach potential, exemplified by Biden's campaign page, highlights its enduring relevance amidst uncertainty surrounding its future in the U.S.

Snapchat and X (formerly Twitter) will also see a share of the spend, although recent changes on X add another layer of challenges as account verification, brand safety and content moderation policies have changed with Musk’s acquisition, giving it the potential to challenge political campaigns through the spread of misinformation.

Paid Search on platforms such as Google, Bing, or retail platforms like Amazon and Walmart won’t see large impacts to costs. While impact will vary by advertiser, the main implication would be for any terms that overlap with political-related keywords.

Geographic and Audience Targeting

Battleground states and specific demographics remain a focus for presidential ad spend, creating intense competition for ad space. AP reports that Biden has created leadership teams with in-state political experience in Arizona, Florida, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin. It also reports that Trump has hired staff in 15 battleground states, including those with pivotal House and Senate races including New York, California and Montana. This will undoubtedly bring a significant amount of investment to support campaigning in these states which will further constrain inventory availability and costs.

Brand Safety Amid Political Discussions

With politics dominating news cycles, brands must prioritize brand safety measures to avoid association with sensitive topics. Utilizing website whitelists, blocklists and robust keyword exclusions helps maintain control over ad placements. Social media platforms present additional challenges, requiring careful moderation to navigate heightened audience sensitivity.

How to Prepare for the Environment

To effectively navigate political campaign spending, advertisers should consider the following strategies:

- Secure inventory early, especially in news, business, TV and CTV environments, to ensure availability and mitigate cost increases.

- Proactively assess marketing plans and pivot to alternative platforms or channels if necessary.

- Scenario-plan to identify potential risks and election outcomes, creating contingency plans accordingly.

- For campaigns or launches that risk being overshadowed by political messaging, consider adjusting your market approach to avoid battleground states or consider a national approach to avoid political saturation. Additionally, consider whether campaign flighting can be adjusted to avoid October, where messaging is less likely to be overshadowed by political spending.

- Increase investment in media monitoring and community management, for ongoing intelligence to stay ahead of key issues that impact brand/reputation in an election cycle.

- Investment in predictive analytics to monitor and prepare for emerging threats that could develop into rand detractors.

- Assess new brand or campaign launches through a political lens to account for increased sensitivities stemming from the political environment.

As political campaign spending reaches unprecedented levels, advertisers face new challenges in capturing consumer attention amidst the noise. By understanding the landscape, implementing proactive strategies, and prioritizing brand safety, advertisers can effectively navigate this dynamic environment and capitalize on emerging opportunities in the evolving realm of political advertising.

Autumn Cueller serves as vice president of performance intelligence for Edelman DXI, where she oversees media strategy, planning, implementation and cross-channel measurement.

Julia Sabetta serves as associate director of paid media for Edelman DXI, where she plans and executes campaigns across paid social, digital, broadcast, print, search and programmatic.